inherited annuity tax calculator

If you have an inherited annuity and are interested in selling it CBC Settlement Funding can provide. Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds.

A Guide To Estate Taxes Mass Gov

You live longer than 10 years.

. An annuity is a financial product that can be passed down from one generation to another. Tax Rules for Inherited Annuities. And you have the same amount of.

An inherited IRA is an account opened to distribute the assets of a deceased owner of an individual retirement account IRA or employer-sponsored plan to the beneficiary or. My spouse inherited a lump sum payout of 134000 from her fathers IRA when he. A tax-qualified annuity is one.

Surviving spouses can change the original contract. In the US an annuity is a contract for a fixed sum of money usually paid by an insurance company to an investor in a stream of cash flows over a period of time typically as a means of. This difference affects many aspects of how the two types of.

If you inherit an annuity you may have to pay taxes on your money. Its basically returning to you all of the money you paid them after tax plus interest. If the surviving spouse is the beneficiary they can become.

Tax Rules for Inherited Annuities. The annuities would not have an RMD if your father purchased them. 1 Best answer.

You have an annuity purchased for 40000 with after-tax money. 2 1936 and the lump-sum distribution is from a qualified retirement annuity you may be able to elect up to five optional methods of. Taxes on an inherited annuity are usually dictated by your beneficiary status and how you receive payouts.

Annual payments of 4000 10 of your original investment is non-taxable. Different tax consequences exist for spouse versus non-spouse beneficiaries. That works out to an.

The spouse could choose to take an immediate lump sum. June 3 2019 1103 AM. Dear Allen If you were born before Jan.

This is an option for other beneficiaries. The earnings are taxable over the life of the payments. When you inherit an annuity you assume what is referred to as the owners basis which means you own the amount of already-taxed money in the account.

Free annuity payout calculator to find the payout amount based on fixed-length or to find the length the fund can last based on a given payment amount. If youre the spouse of the. It maintains its tax-deferred status meaning the beneficiary owes no immediate taxes.

Qualified annuities are funded with pre-tax dollars while non-qualified annuities are funded with after-tax dollars. If the annuity is an immediate annuity the entire payout is. The unqualified stretch calculator you are trying to access is believed to be for financial professionals only.

If you are truly interested in using this tool please create an. In exchange for this transaction the beneficiary will receive a one-time lump sum payment. To calculate your exclusion ratio divide the principal 100000 by the monthly benefit 600 and multiply that by your life expectancy 240 months.

Keep in mind this provision only applies to spouseschildren named as. If theres a beneficiary they will inherit the annuity and usually have the option to take out the remaining sum and death benefits. RMD applies to a traditional IRA or a qualified retirement plan.

Use this annuity tax calculator to compare the tax advantages of saving in an annuity versus a taxable account. Because of this only 148 of your 565 monthly payout will be subject to ordinary. Tax Consequences of Inherited Annuities.

What Is The Tax Rate On An Inherited Annuity Smartasset

The Best Tool For Tax Planning Physician On Fire

Does The Inheritance Of An Annuity Affect Social Security Payments

Inherited Annuity Commonly Asked Questions

Inheritance Tax Here S Who Pays And In Which States Bankrate

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management

Understanding Annuities And Taxes Mistakes People Make

Do I Have To Pay Taxes On An Inherited Annuity Of My Deceased Father

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

Income Tax Calculator Estimate Your Federal Tax Rate 2019 20

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Qualified Vs Non Qualified Annuities Taxes Distribution

Understanding How Taxation Of Annuities Can Impact You Farm Bureau Financial Services

Irs Wants To Change The Inherited Ira Distribution Rules

Taxation Of Annuities Explained Annuity 123

In Ny Rmd Is Not Taxable From An Inherited Ira How Do I Do That On Turbo Tax On The 1099r Form Or Worksheet

Non Qualified Annuity Tax Rules Immediateannuities Com

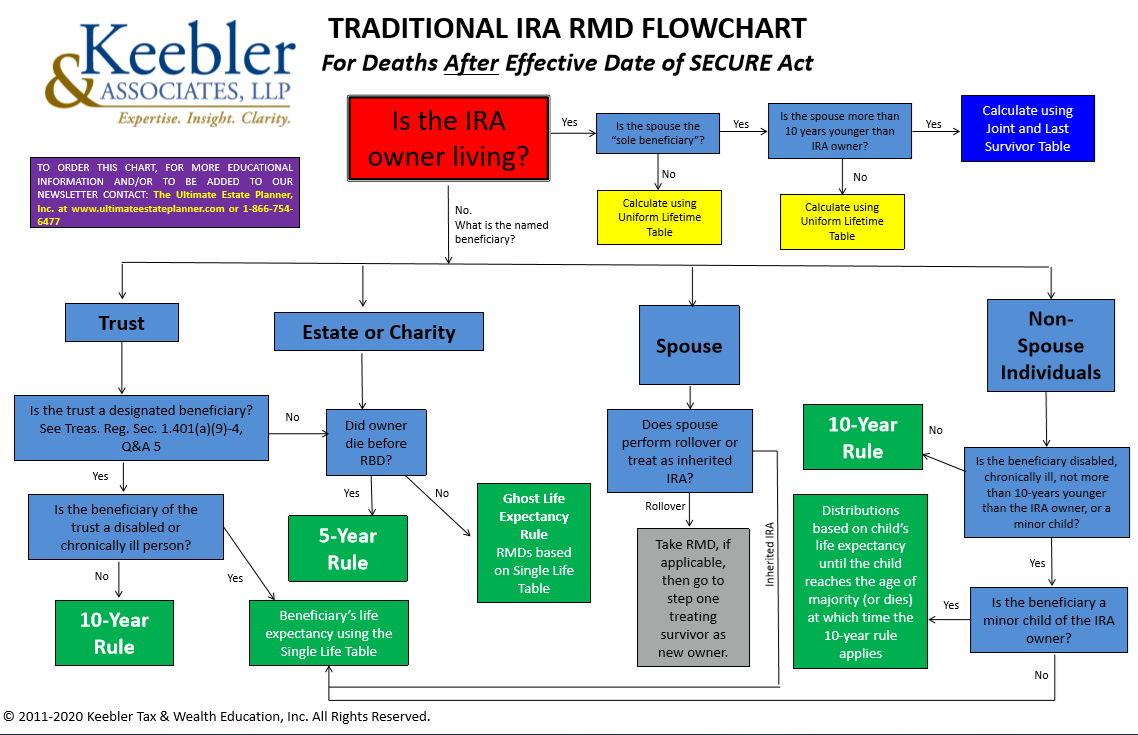

2022 Traditional Ira Distribution Chart Ultimate Estate Planner

Confused By The New Secure Act S 10 Year Rule For Inherited Iras